25C TAX CREDIT INFORMATION

Mr. Comfort Heating Cooling & Duct Cleaning

Have a heating or cooling-related questions about the 25C tax credit. Please see the tax credit information below for answers.

CEE Residential Heating and Cooling Specification Update

- CEE has released updates to their specification for installations occurring after January 1, 2025, as well as for installations occurring after January 1, 2026.

❖ The 25C tax credit of the Inflation Reduction Act (IRA) must align with CEE’s highest tier (excluding the advanced tier)

2025 Installation Specification Highlights:

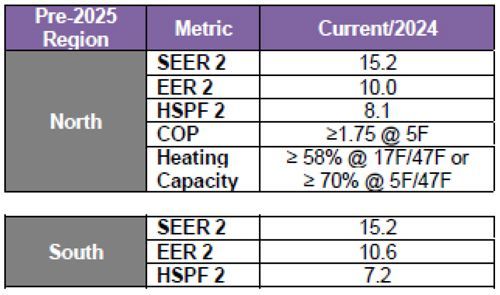

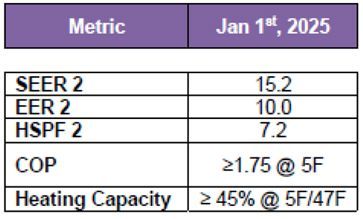

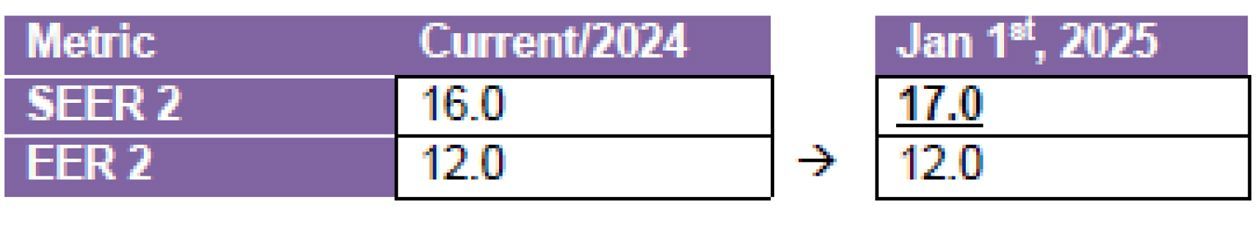

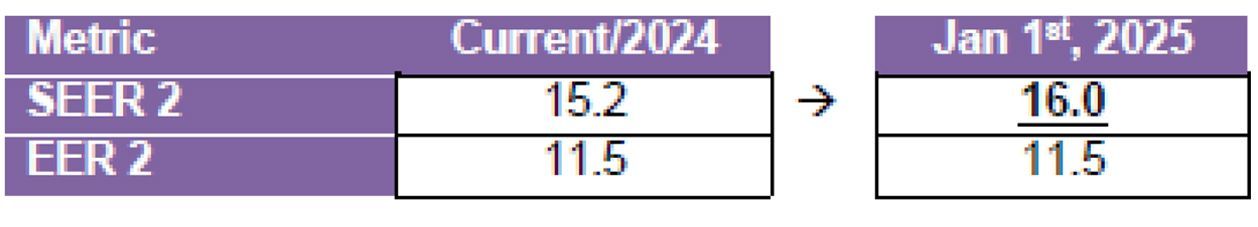

❖ AC Changes

- Higher SEER2 requirements

❖ Heat Pump Changes

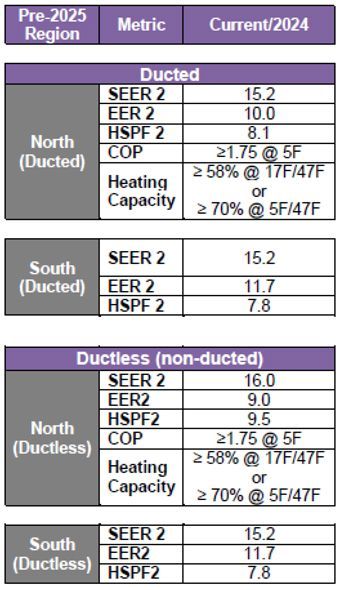

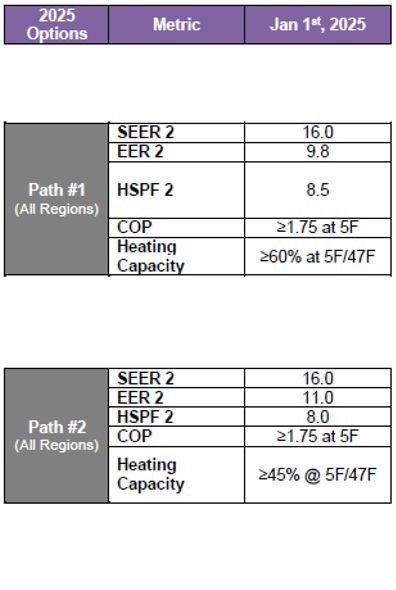

- Removed Ducted versus Non-Ducted spec differences

- Higher SEER2 requirements

- Higher HSPF2 requirements

- Lower EER2 requirements

- Different heating capacity ratio requirements – removed the 17F/47F option

- Removed “North” and “South” designations and replaced them with paths that are:

- “intended” for “cooling dominated/dual fuel” or

- “intended” for “heating dominated/whole home electrification”

2025 CEE Specification – Heat Pump Changes

Split Heat Pump Specification

SPP Heat Pump Specification

2025 CEE Specification – AC Changes

Split AC Specification

SPP AC Specification

Share On: